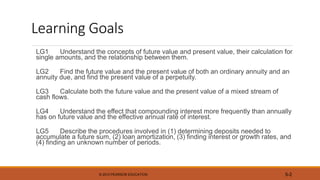

64+ the time value concept/calculation used in amortizing a loan is

Future calue of a. Future value of an annuity.

:max_bytes(150000):strip_icc()/residual-value-4190131-final-1-c98e52a4e3474d248acab1a8807b1eca.png)

Residual Value Explained With Calculation And Examples

The payment for the use of borrowed money is called.

. The most capable and trusted financial calculation solution since 1984. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that. Future calue of a.

The ____ value of a savings or investment is its amount value at. Present calue of an annuityD. The most capable and trusted financial calculation solution since 1984.

Web Study with Quizlet and memorize flashcards containing terms like The effective rate of interest is the contractual rate of interest charged by a lender or promised by a borrower. A relative has offered to give you. Future calue of an annuity.

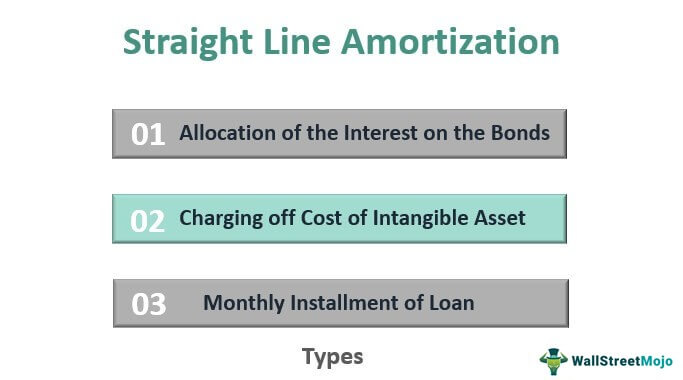

Web Amortization is the accounting process used to spread the cost of intangible assets over the periods expected to benefit from their use. Under the effective interest method the interest is calculated as yield to maturity multiplied by. Web Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan.

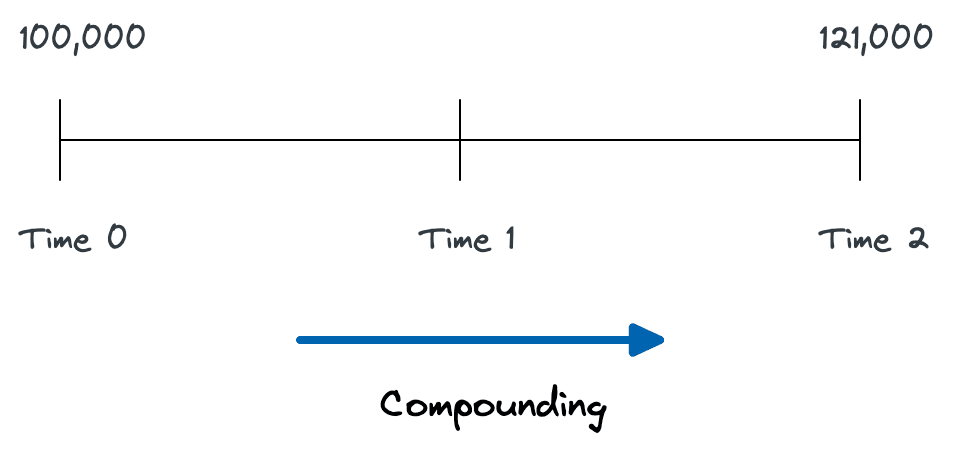

Web There are two methods used to amortize bond discounts or premiums. The following examples demonstrate how to calculate the time value of money. Present Value of a dollar.

Web Examples of the time value of money. To determine what lump sum has the same value as. In a fully-amortized loan each payment is part interest and part.

Web Study with Quizlet and memorize flashcards containing terms like Since individuals are always confronted with opportunities to earn positive rates of return on their funds the. The Terminologycalculation time value used in amortizing a loan is- 3 Points future value of a dollar. If a loan is repaid over its term in equal periodic installments the loan is fully amortized.

Web the ____ value of a savings or investment is its amount value at the current time. Calculate Interest Principal APR More. In banking and finance an amortizing loan is a loan where the principal of the loan is paid down over the life of the loan that is amortized according to an.

The customary method for. Ad Expand your Financial Calculation Capabilities. Web The time value conceptcalculation used in amortizing a loan is.

Present calue of an annuity. Calculate Interest Principal APR More. Present value of a dollar d.

Future value of a dollar b. Web A famous athlete is awarded a 9 million contract that stipulates equal payments to be made monthly over a period of five years. Our calculations have used what is known as the.

Present value of. Web Web The time value conceptcalculation used in amortizing a loan is a. The effective-interest method and the straight-line method.

Terms in this set 49 present. Ad Expand your Financial Calculation Capabilities. Web Amortization Schedule.

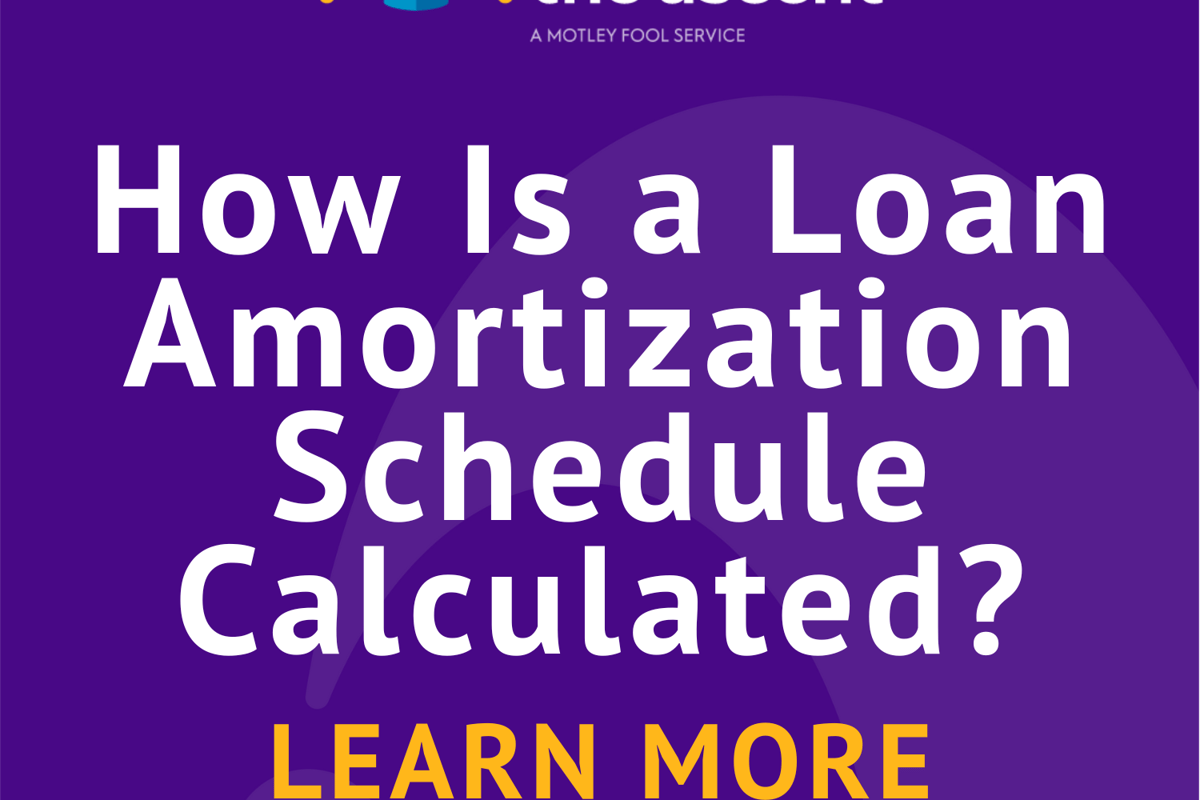

How Is A Loan Amortization Schedule Calculated The Motley Fool

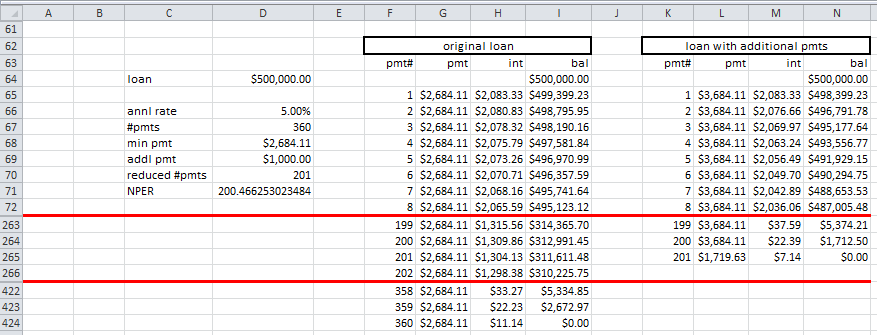

I Need A Formula To Calculate A Loan Payment With Additional Principle Added To Accelerate Payoff Microsoft Community Hub

Bba 2204 Fin Mgt Week 5 Time Value Of Money

:max_bytes(150000):strip_icc()/Term-Definitions_Opportunity-cost2-614cfb37567040879073c5ed1d03b25c.png)

Opportunity Cost Formula Calculation And What It Can Tell You

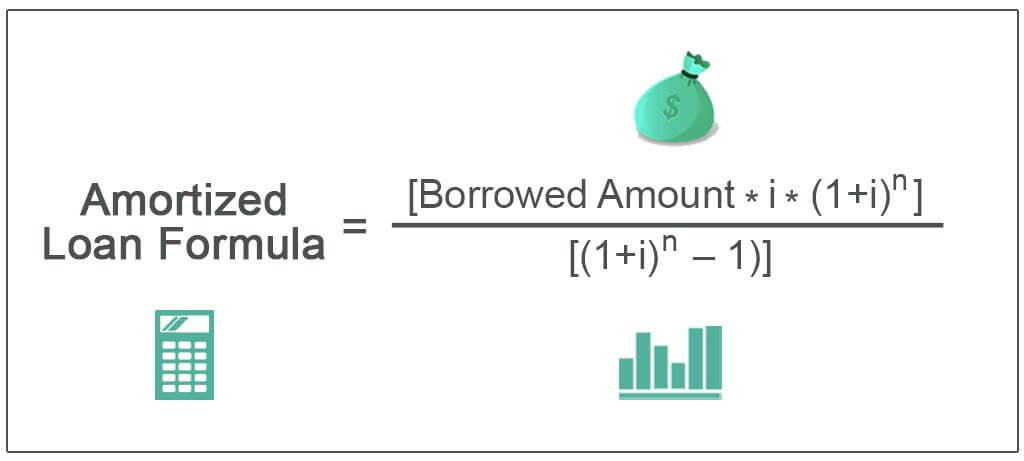

Amortized Loan Formula How To Calculate Examples

Time Value Of Money

I Need A Formula To Calculate A Loan Payment With Additional Principle Added To Accelerate Payoff Microsoft Community Hub

Straight Line Amortization Formula Types Calculation Examples

:max_bytes(150000):strip_icc()/historical-cost-4195079-final-1-d728fd1156554296a0335140ed17a8a3.png)

Historical Cost Definition Principle And How It Works

Pik Interest Formula Calculator

Chapter 5 Time Value Of Money Pptx

Time Value Of Money

Annual Percentage Rate Wikipedia

Ebitda Meaning Importance Formula Calculation Example

Perpetuity Formula Present Value Calculator Pv

:max_bytes(150000):strip_icc()/DDM_INV_written-down-value_df-3x2-4b8ad402814b4e1bbcd495b612dc93ad.jpg)

Written Down Value Wdv What It Is And How To Calculate It

.png)

What Is Amortisation Amortisation Meaning Ig Uk